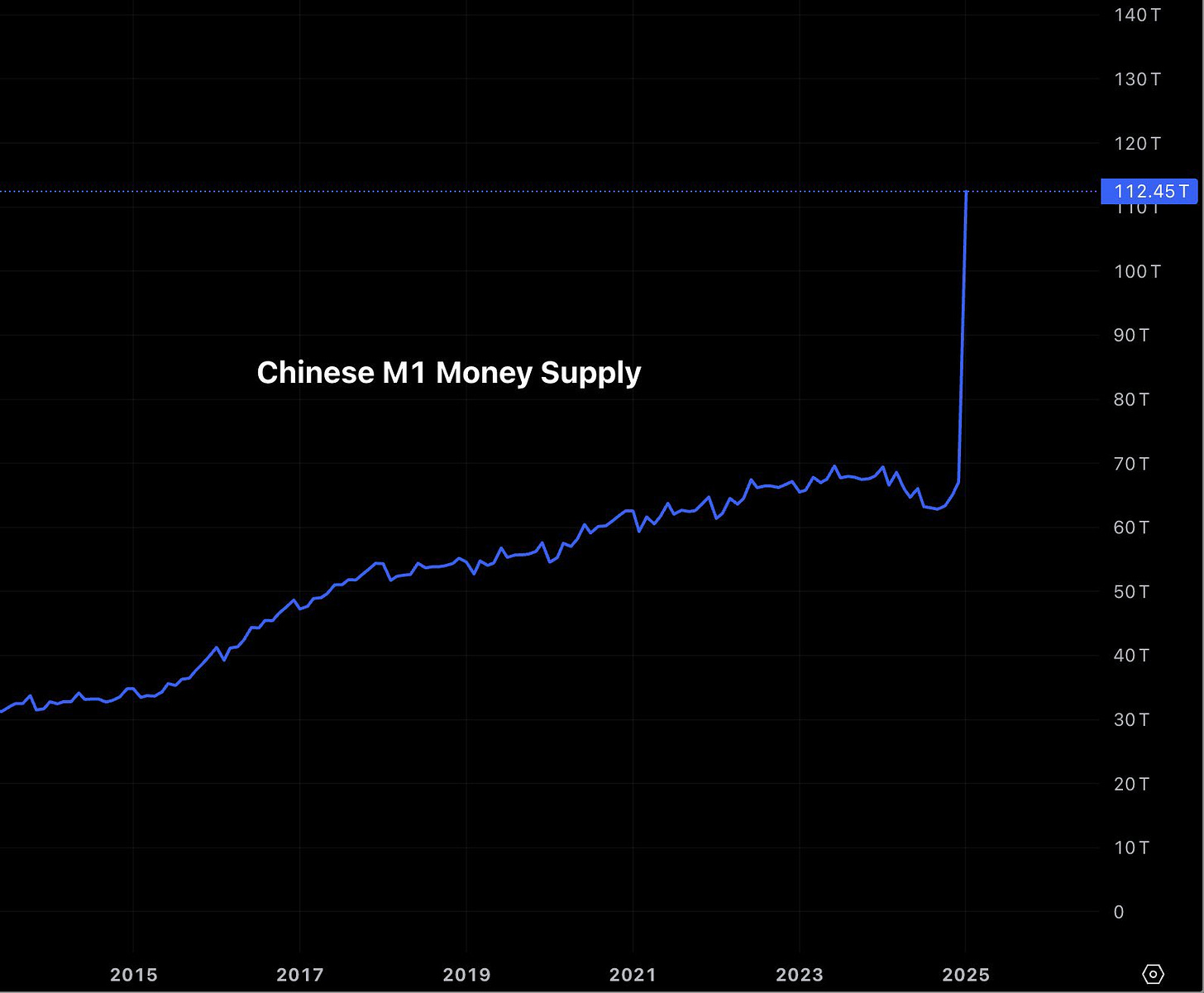

China's M1 Money Supply Surge: A Statistical Adjustment, Not a Liquidity Boom

In January 2025, China's M1 money supply saw a significant jump from approximately 67 trillion yuan in December 2024 to 112 trillion yuan. However, this increase was not due to an actual liquidity injection but rather a recalibration of the calculation methodology by the People's Bank of China (PBOC). This change, effective from January 2025, now includes personal demand deposits and customer reserves held by non-bank payment institutions, providing a more comprehensive view of liquidity in China's economy.

Understanding the Change

Before this adjustment, M1 comprised currency in circulation (M0) and corporate demand deposits. The revision aligns China's financial metrics with international standards and reflects an evolving financial landscape. While the change aims to offer a clearer economic picture, some analysts speculate that it may also serve to obscure ongoing economic difficulties, such as deflationary pressures and sluggish growth.

Key Facts Behind the Numbers

M1 Calculation Revision: The adjustment was announced in December 2024 and implemented in January 2025.

Statistical Surge: The reported increase does not represent a sudden influx of liquidity but a broader accounting scope.

Economic Implications: Some experts believe the change may mask liquidity injections aimed at countering a deflationary debt spiral.

China’s Inflation Challenges: With an inflation rate at 0% per year—well below its 3% target—China's economy faces deflationary risks.

Money Supply Growth Rate: M2 growth is around 7.25% per year, still below the estimated 11% needed to meet inflation targets.

What This Means for Global Markets

The revised M1 figures have sparked debate across financial markets, with many on social media misinterpreting the data as evidence of massive liquidity injections. However, deeper analysis shows that the surge is merely a statistical artifact, not a policy shift.

Meanwhile, China’s broader economic indicators suggest that the country remains in a precarious position. In December 2024, China's M1 money supply had already seen a year-over-year decline of 1.41%, raising concerns about economic momentum. Furthermore, in response to weak recovery signals, the PBOC ramped up new bank loans in January 2025, hitting a record 5.13 trillion yuan—well above analyst expectations.

The Bottom Line

While the dramatic rise in China's M1 supply has made headlines, investors should be cautious in interpreting it as a sign of rapid monetary expansion. Instead, this change reflects a shift in measurement rather than a fundamental shift in policy.

For market participants, the key takeaway is to rely on data-driven insights rather than viral narratives. The real question remains whether China’s economic policies can effectively navigate ongoing deflationary pressures and sustain long-term growth.