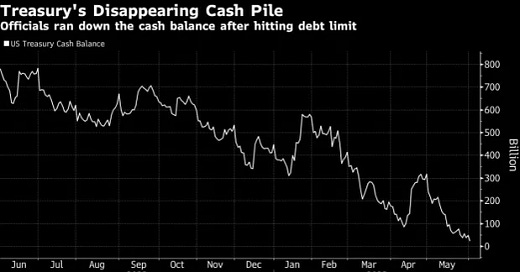

The bipartisan resolution was successfully passed by President Biden on Saturday, thus stopping the US$ 31.4tr debt ceiling and reducing the chance of a US federal government default. Just US$ 33 billion of those extraordinary accounting measures were still available as of May 31st, and the Treasury was utilising them to sustain payments on all government commitments. Additionally, it has been depleting its cash position, which, as a result of the erratic daily government receipts and transfers, fell to below US$ 23 billion on June 1 and is now at a dangerously low level. Biden's signature on this law suspends the debt ceiling until 2025. The government had estimated a $ 550 billion cash balance for the end of June at the beginning of the month.

The anticipated increase in debt auctions may include the issuance of new assets worth more than US$ 1 trillion. By reducing liquidity in the banking industry, increasing short-term financing rates, and tightening the screws on an economy that analysts believe is headed for a recession, this approach may have unforeseen consequences.

According to Bank of America, this issue may have an effect similar to that of a 0.25% Fed interest rate increase.

A deluge of Treasury bonds, according to JPMorgan strategist Nikolaos Panigirtzoglou, would amplify the impact of QT on equities and bonds this year, reducing their aggregate performance by about 5%. Similar calculations are provided by Citigroup's macro analysts, who predict that a significant liquidity depletion could result in a median decrease of 5.4% in the S&P 500 over the course of two months and a shock of 37 basis points for high-yield credit spreads.

Every asset class will be affected by the sales, which will claim a portion of the money supply that is already in decline: According to JPMorgan, a general measure of liquidity will decrease by US$ 1.1 trillion by the end of 2023 from roughly US$ 25 trillion. Nick Panigirtzoglou

This represents a huge liquidity outflow. It's not often that we witness something like that. Only in catastrophic disasters like the Lehman crisis do you witness a shrinkage like that.According to JPMorgan, this tendency will cause the measure of liquidity to decline at a 6% annual rate in contrast to the annualised rise seen for the majority of the past 10 years.

As a result, the market's attention is now on determining how the bond market will respond to the influx of Treasury securities and the effects of topping off the Treasury General Account (TGA) at the Federal Reserve (Fed) with $500 billion to $600 billion, particularly with regard to banking system liquidity. According to JPMorgan, the deluge would amplify the impact of QT on stocks and bonds, while Citi predicts a 5.4% decline in the S&P 500 over the next two months. Through Friday, a May 24 options wager on Equitrans had yielded almost US$ 7.5 million in paper profits.

AI Hype

Yes, the S&P 500 is up 12% this year, but without the support of 7 significant IT companies, it would be down. That may make the index susceptible to a sharp decline if merely one or two major corporations make a mistake (WSJ).

BCA Research on the performance of the IT industry. Compared to the S&P 500, the IT sector's sales-per-share have grown by 45% since 1996, while earnings-per-share have climbed by 112%, and price-per-share has soared by 216%. Thus, a narrow set of firms' expanding profit margins and the higher PE multiples that investors allocated to them can be responsible for almost 80% of the outperformance of IT equities.

Mega-cap technology has been compared to the internet stocks of the late 1990s, according to Ned Davis Research on Big Techs. The main distinction is that the current bunch is quite successful. However, their market-cap relative to earnings weight has grown significantly and may be about to break.

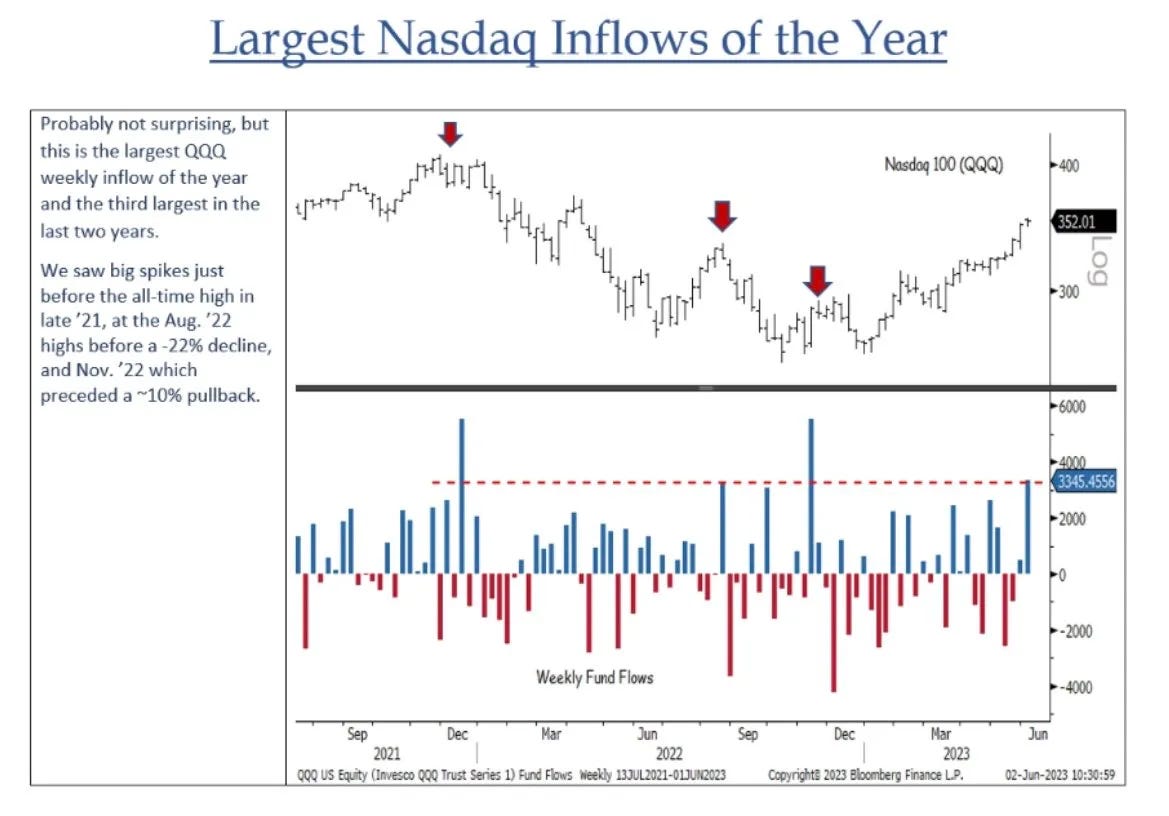

BTIG on the Tech Stock Rally: "We continue to be dubious about the long-term viability of this rally. [...] The highest weekly inflow into $QQQ of the year just occurred. This is normally contrarian since it indicates that investors are entering a move out of "FOMO"

A significant ETF provider believes the artificial intelligence boom is only getting started. Less than 20 days have passed since Roundhill Investments introduced the Generative AI & Technology ETF (CHAT). It is the first exchange-traded fund created specifically to follow businesses using generative AI and associated technologies. The fund comprises large-cap tech businesses like Microsoft and AI chipmaker Nvidia in addition to pure play AI firms like C3.ai. CNBC

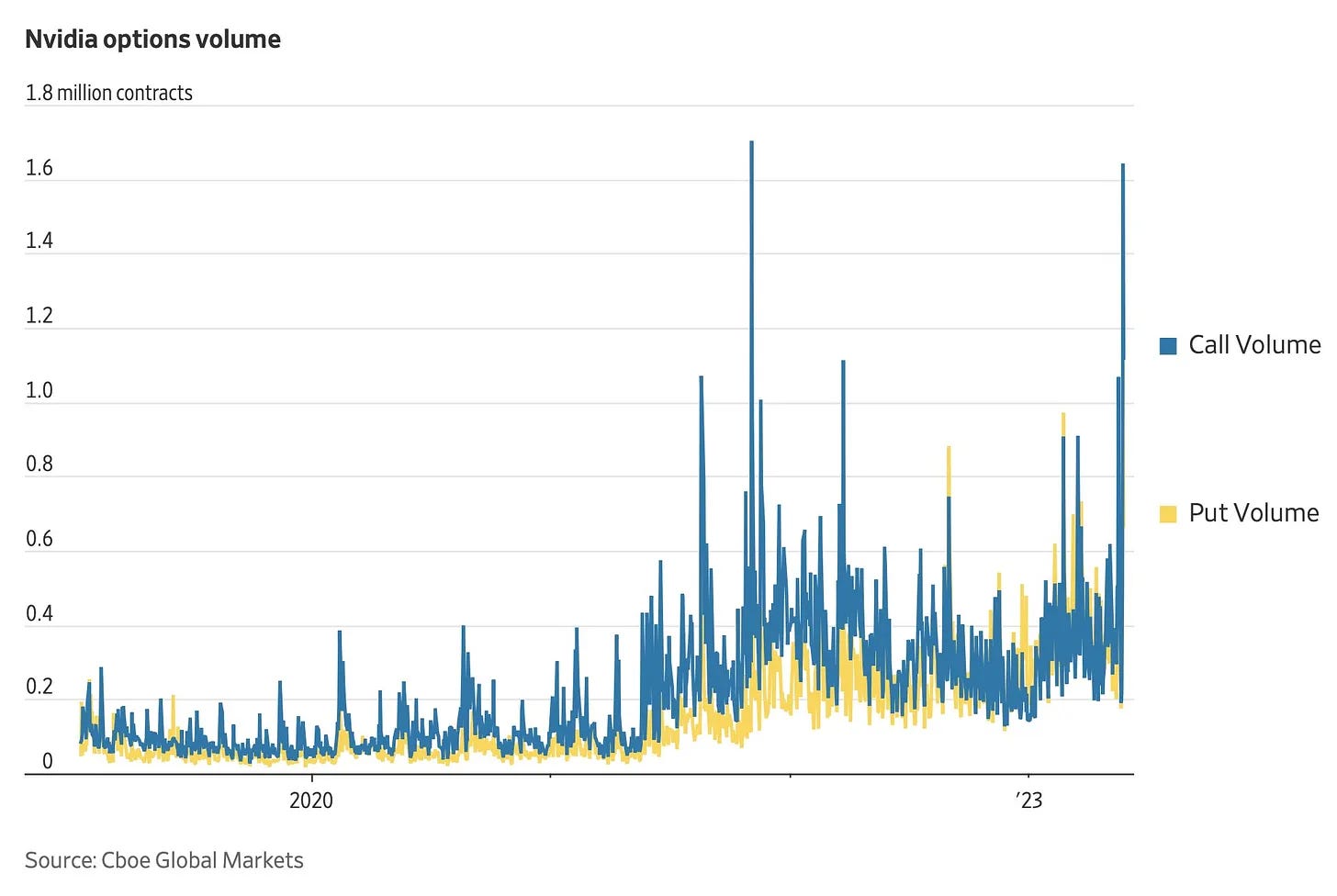

The frenzied activity in the options market demonstrates the number of traders eager to up the ante on their bets on Nvidia. The situation is similar to the buzz over Tesla shares—and its options—in 2021. After a 30% YTD advance and a 55% surge in Semis, Citi stated that "performance chasing in tech is evident in options flows that may reflect capitulation in the space."